Wealth Shouldn't Be a Privilege

It Should Be a Possibility For All

We're on a mission to make smart investing accessible, understandable,and achievable - no matter your income, background, or experience.

SEBI-registered

SEBI-registered Bank-grade security

Bank-grade security Transparent fees

Transparent fees

Rely on unverified advice or random app

Millennials say they want to invest but don't know how

Financial literacy rate in India

Indians invest in mutual funds

For Your Dreams And Aspirations

At Fydaa, we help you direct every rupee with purpose - whether you're spending on today, saving for tomorrow, or investing for the future.

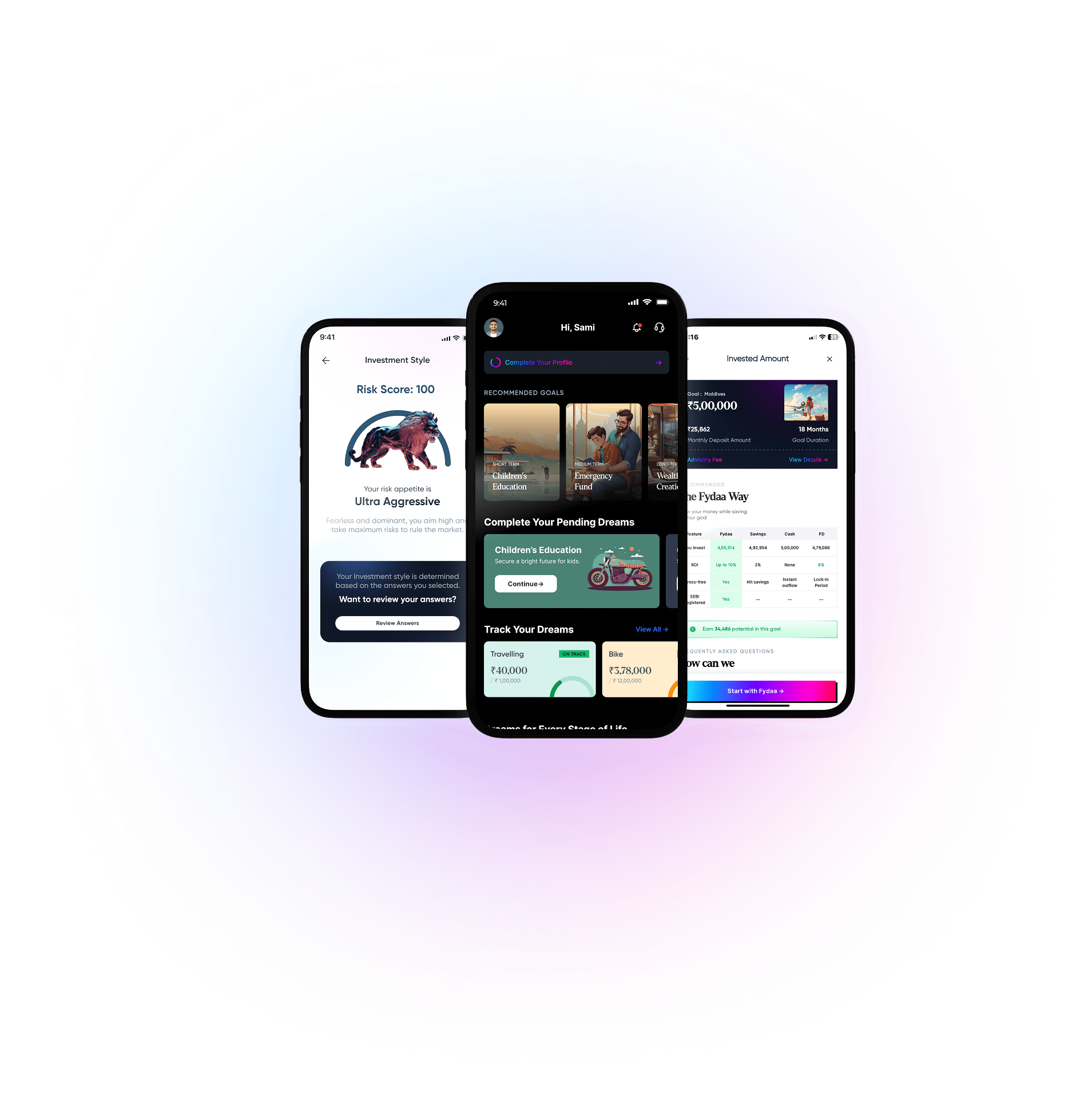

One Hand for All Your Financial Planning

One app, many goals - everything you need to manage money smartly, in one place.

Investment Planning

Align your investment with your time horizon and risk appetite.

HERE'S WHAT YOU GET

Risk assessment test

Asset allocation strategy

Suggested mutual funds/ETFs

Periodic rebalancing reminders

Emergency Fund Setup & Guidance

Build a reliable financial cushion for emergencies, job loss, or medical needs.

HERE'S WHAT YOU GET

Personalized emergency fund target

Savings options for liquidity

Monthly reminders to build the corpus

Guidance on fund placement (FDs, liquid funds)

Debt Management & Refinancing

Pay off your liabilities smarter with expert-backed strategies tailored for your financial health.

HERE'S WHAT YOU GET

Personalized debt repayment roadmap

Refinance suggestions to reduce EMI burden

Consolidation options for multiple loans

Monthly progress tracking

Expense Management

Gain clarity on where your money goes every month.

HERE'S WHAT YOU GET

Smart categorization of expenses

Expense-saving tips

Monthly budget deviation alerts

Spending summary dashboard

Financial Health Checkup

A complete diagnostic of your current financial condition.

HERE'S WHAT YOU GET

Net worth snapshot

Savings-to-expense ratio

Risk exposure analysis

Report with expert suggestions

Personalized Budgeting Plan

A custom budget, created around your income, lifestyle, and future goals.

HERE'S WHAT YOU GET

Income-expense allocation plan

Dynamic budgeting tracker

Realistic savings goals

Monthly report card

Tax Consultancy

Expert help in planning your taxes and maximizing exemptions.

HERE'S WHAT YOU GET

Personalized tax-saving report

Investment-linked deductions

Capital gains advice

Year-end tax planning session

Portfolio Management

Track, Optimize, and enhance your overall investment performance.

HERE'S WHAT YOU GET

Investment tracking dashboard

Health score of your portfolio

Rebalancing tips

Alerts on overexposure or underperformance

Investment Planning

Align your investment with your time horizon and risk appetite.

HERE'S WHAT YOU GET

Risk assessment test

Asset allocation strategy

Suggested mutual funds/ETFs

Periodic rebalancing reminders

Emergency Fund Setup & Guidance

Build a reliable financial cushion for emergencies, job loss, or medical needs.

HERE'S WHAT YOU GET

Personalized emergency fund target

Savings options for liquidity

Monthly reminders to build the corpus

Guidance on fund placement (FDs, liquid funds)

Debt Management & Refinancing

Pay off your liabilities smarter with expert-backed strategies tailored for your financial health.

HERE'S WHAT YOU GET

Personalized debt repayment roadmap

Refinance suggestions to reduce EMI burden

Consolidation options for multiple loans

Monthly progress tracking

Expense Management

Gain clarity on where your money goes every month.

HERE'S WHAT YOU GET

Smart categorization of expenses

Expense-saving tips

Monthly budget deviation alerts

Spending summary dashboard

Financial Health Checkup

A complete diagnostic of your current financial condition.

HERE'S WHAT YOU GET

Net worth snapshot

Savings-to-expense ratio

Risk exposure analysis

Report with expert suggestions

Personalized Budgeting Plan

A custom budget, created around your income, lifestyle, and future goals.

HERE'S WHAT YOU GET

Income-expense allocation plan

Dynamic budgeting tracker

Realistic savings goals

Monthly report card

Tax Consultancy

Expert help in planning your taxes and maximizing exemptions.

HERE'S WHAT YOU GET

Personalized tax-saving report

Investment-linked deductions

Capital gains advice

Year-end tax planning session

Portfolio Management

Track, Optimize, and enhance your overall investment performance.

HERE'S WHAT YOU GET

Investment tracking dashboard

Health score of your portfolio

Rebalancing tips

Alerts on overexposure or underperformance

Investment Planning

Align your investment with your time horizon and risk appetite.

HERE'S WHAT YOU GET

Risk assessment test

Asset allocation strategy

Suggested mutual funds/ETFs

Periodic rebalancing reminders

Emergency Fund Setup & Guidance

Build a reliable financial cushion for emergencies, job loss, or medical needs.

HERE'S WHAT YOU GET

Personalized emergency fund target

Savings options for liquidity

Monthly reminders to build the corpus

Guidance on fund placement (FDs, liquid funds)

Debt Management & Refinancing

Pay off your liabilities smarter with expert-backed strategies tailored for your financial health.

HERE'S WHAT YOU GET

Personalized debt repayment roadmap

Refinance suggestions to reduce EMI burden

Consolidation options for multiple loans

Monthly progress tracking

Expense Management

Gain clarity on where your money goes every month.

HERE'S WHAT YOU GET

Smart categorization of expenses

Expense-saving tips

Monthly budget deviation alerts

Spending summary dashboard

Financial Health Checkup

A complete diagnostic of your current financial condition.

HERE'S WHAT YOU GET

Net worth snapshot

Savings-to-expense ratio

Risk exposure analysis

Report with expert suggestions

Personalized Budgeting Plan

A custom budget, created around your income, lifestyle, and future goals.

HERE'S WHAT YOU GET

Income-expense allocation plan

Dynamic budgeting tracker

Realistic savings goals

Monthly report card

Tax Consultancy

Expert help in planning your taxes and maximizing exemptions.

HERE'S WHAT YOU GET

Personalized tax-saving report

Investment-linked deductions

Capital gains advice

Year-end tax planning session

Portfolio Management

Track, Optimize, and enhance your overall investment performance.

HERE'S WHAT YOU GET

Investment tracking dashboard

Health score of your portfolio

Rebalancing tips

Alerts on overexposure or underperformance

Unsure About Your Needs?

Our Recommended Packages

Wealth Growth Plan

Accelerate growth, maximize your potential

Debt Management & Refinancing

Expense Management

Emergency Fund Setup & Guidance

Investment Planning

Portfolio Management

Tax Consultancy

Personalized Budgeting Plan

Disciplined Saving Planning (Fydaa SIP)

Financial Health Checkup

Retirement Planning

Insurance

Educational Content

Financial Foundation Plan

Start saving smart, build long-term wealth

Debt Management & Refinancing

Disciplined Saving Strategy (Fydaa SIP)

Emergency Fund Setup & Guidance

Investment Planning

Goals setup

Insurance

Financial Health Monitoring

Educational Content

Financial Fresh Start Plan

Regain balance, build a strong base

Debt Management & Refinancing

Expense Optimization

1:1 Financial Counselling

Smart Budgeting

Expense-Saving Balance

Educational Content

EMI nahi Fydaa SIP se achieve karo apne sapne.

EMIs often mean borrowing for things you can't afford yet, adding stress and interest. Fydaa SIPs help you build wealth gradually, giving you control and peace of mind while you plan your dreams.

The Fydaa Experience

Every user is different. That's why our plans are built just for you.

Understand Your Money Habits

Understand Your Money Habits

You Lose Crores... Just in Hidden Fees

Regular agents or platforms often take 1.5-2% yearly as trail commission, silently eating away your compounding.

Fydaa charges a nominal fixed fee per month with full transparency,

so you grow more, keep more.

Fydaa vs Traditional Advisers

We're not here to throw jargon at you. We walk with you through every step.

| Fydaa | Traditional Advisers | |

|---|---|---|

Regulation | 100% SEBI-registered advisers | Not always SEBI-registered |

Transparency | Flat ₹20 fee, no hidden commissions | Often unclear fees or hidden commissions |

Personalization | Plans tailored to your income, goals & risk profile | Generic advice or one-size-fits-all |

Accessibility | Instant access via app, chat anytime | In-person, hard to reach, slow follow-up |

Technology | App-first, automated tracking + human guidance | Manual reports, no app or real-time tracking |

Conflict of Interest | No bias - we don't sell products | May push products for commission |

Cost | Affordable ₹20 advice per session | High consultation fees or % of investments |

User Experience | Friendly, simplified explanations for young investors | Old-school, intimidating language |

Regulation

Transparency

Personalization

Accessibility

Technology

Conflict of Interest

Cost

User Experience

Real People, Real Progress

Hello, my name is Abhishek Misra, and I am a CS professional. I have been using the Fydaa app since 2022. I chose the Fydaa app because investing through it is very effortless, and more importantly, it allows me to invest in multiple asset classes like gold, real estate, and equity—all within a single app. I would definitely recommend using the Fydaa app if you are looking for a disciplined way of investing. Thank you for letting me share my journey with Fyda, and I hope it inspires you to begin your own investment journey.

"Abhishek Mishra

Abhishek Mishra

Hello, my name is Abhishek Misra, and I am a CS professional. I have been using the Fydaa app since 2022. I chose the Fydaa app because investing through it is very effortless, and more importantly, it allows me to invest in multiple asset classes like gold, real estate, and equity—all within a single app. I would definitely recommend using the Fydaa app if you are looking for a disciplined way of investing. Thank you for letting me share my journey with Fyda, and I hope it inspires you to begin your own investment journey.

"

Start Early, Start Small

JUST START

Every day you delay costs you money.

FAQs

Feel free to contact us if you have any questions after reviewing our FAQs.